Divorce is overwhelming — emotionally, financially, legally. With so much vying for your attention, where do you even begin?

My answer: Start with your finances.

All your other decisions will flow from knowing the resources you and your spouse have available to you.

How much there is to divide.

How much you’re able and willing to spend on your divorce process.

How much each of you will need to fund a fulfilling life after divorce.

This is why I created the Finances FIRST Framework and Strategy Series.

I guide you through my framework — step by step — in order to:

Reduce the overwhelm you’re feeling.

Make key decisions in a logical order.

Focus on the reality of your situation, not what anyone else says your divorce should be like.

If you’re ready to start feeling in control of your financial future, you’re in the right place!

In this introductory strategy series of 12 sessions, six strategy sessions cover the five key components of the Finances FIRST Framework (see below), with a bonus deep-dive session for your specific needs. The series also includes six coaching sessions to focus on what’s most urgent or timely in your divorce. Plus you get email or phone support between sessions, organizing templates, Your Upward Divorce Guidebook, and much more.

“I really appreciate our sessions and it’s so nice to experience support in a positive way—I hadn’t realized how much I had NOT been receiving support!”

What to do F.I.R.S.T.? I’ve got you covered.

My Finances FIRST Framework uses the acronym F.I.R.S.T. The following five topics are covered in our six strategy sessions, typically in this order. Click the down arrows to learn more.

-

Before we dive into the numbers, we explore how are you feeling about the separation, the money, and your future. From here on out, we face forward, because that’s where you’re going.

We do a vision exercise to help you imagine your life a few years after the divorce. I need to know where you are now and where you want to go — because we can't plan your route without a destination to aim for. -

This is the part where we take stock of what you own and what you owe. We create an initial inventory of your financial accounts, property, and significant assets — from retirement accounts to real estate, cars to collectibles. I give you feedback on the complexity of your situation. I provide customized checklists and templates to make this as organized and manageable as possible.

-

For most couples, their home and retirement savings (and maybe a business) are their biggest assets. This is where we note what was acquired and earned during your marriage (“community property”) versus what could be considered “separate property.” We also consider liquidity (ease of accessing funds) and the tax implications of dividing these “R” assets. This isn’t just about splitting things down the middle; it’s about understanding the impact of the choices.

-

Child or spousal support — or both — may be merited in your divorce. Here we look at your cash flow needs and get realistic about your post-divorce lifestyle. While Washington State has a formula for child support, spousal support (aka “maintenance”) is more nuanced. I help you with a preliminary budget and understanding of your rights and responsibilities, so you can negotiate a fair support agreement. We’ll also discuss who can stay on whose health, home and vehicle insurance and for how long.

-

Here, we consider the timing of your divorce, working around significant milestones like the ages and stages of your children, career trajectories, tax filings, etc. We go over the various routes to divorce in Washington State. We also discuss building the right divorce team — the professionals who will support you through your chosen process. A divorce budget is drafted based on your choices.

(Spoiler alert: I believe starting with a financially-focused divorce coach and figuring out HOW you want to divorce before hiring an attorney is a smart, cost-effective move!)

-

What else needs to be addressed in your divorce? If you have children aged 18 or younger, we discuss the need for a parenting plan and resources to guide you. If you are planning to live apart for a while before your divorce is finalized, we strategize how to set up two households and split costs. We can examine optimal tax filing strategies before and after divorce, or explore how ex-spouse Social Security benefits may work on your behalf. Or we’ll take an extra session to dive deeper into one of the five topics above.

Your investment in yourself and your future: $2,997

Pay-in-full bonus: 6-month subscription to Monarch Money software (see details below).

Payment plan option: initial payment of $997 + $500/month invoiced for 5 months.

Utilize your 12 sessions within 12 weeks or 6 months ~ we work within your timeline.

For a fraction of an attorney’s retainer fee, invest in these 1:1 strategic sessions and start your divorce off on the right foot. Yes, you’ll likely need an attorney on your team — but first let’s figure out what’s at stake, and the most cost-effective way to get you the right legal counsel for your situation.

The Finances FIRST strategy series gives you the foundational building blocks you will need for your divorce process. The primary deliverable is an inventory of your assets and debts, along with suggested division scenarios.

☑️ You can take this financial information to your attorney and be welcomed as a model client.

(And if you haven’t found an attorney yet, I’ll provide referrals.)

☑️ Or you can take it to your kitchen table and present a clear, fair proposal to your spouse.

(And if you aren’t in full agreement, I can suggest mediators who will get you there.)

What you get in the Finances FIRST Strategy Series:

👥 1:1 Coaching

6 Deep-Dive Strategy Sessions (up to 90 min.)

6 Focus Coaching Sessions (up to 45 min.)

Check-in calls to maintain momentum

Coach-reviewed email drafts & messaging guidance

48-hour email support between sessions

Accountability to keep you moving forward

🧾 Strategic Tools

Online guidebook for sharing resources, ideas and questions

Exercises & assessments

Checklists & worksheets

Scripts and tips for communicating with your spouse, kids, etc.

📊 Financial Guidance

Inventory & analysis of marital assets + debts

Suggested split scenarios with tax impact

Child and spousal support demystified

Social Security rules explained

Tax filing strategies, pre- and post-divorce

You’ll get crystal clear on your financial picture so you can make informed decisions on issues that affect the rest of your life.

Plus you’ll get strategies for saving time, stress and money in your divorce process.

For some clients, this series kickstarts their divorce and they are off and running with a solid legal team. Others have me walk beside them throughout their entire divorce, as their coach and financial educator and advocate.

Once you complete the Finances FIRST Strategy Series, you may book additional sessions with me or move into my monthly program for more support. Consider me your financial BFF as you evaluate counter-proposals, decide what additional divorce professionals are worth hiring, and start to manage money separately from your spouse — perhaps for the first time in your life.

Bonus when you pay in full:

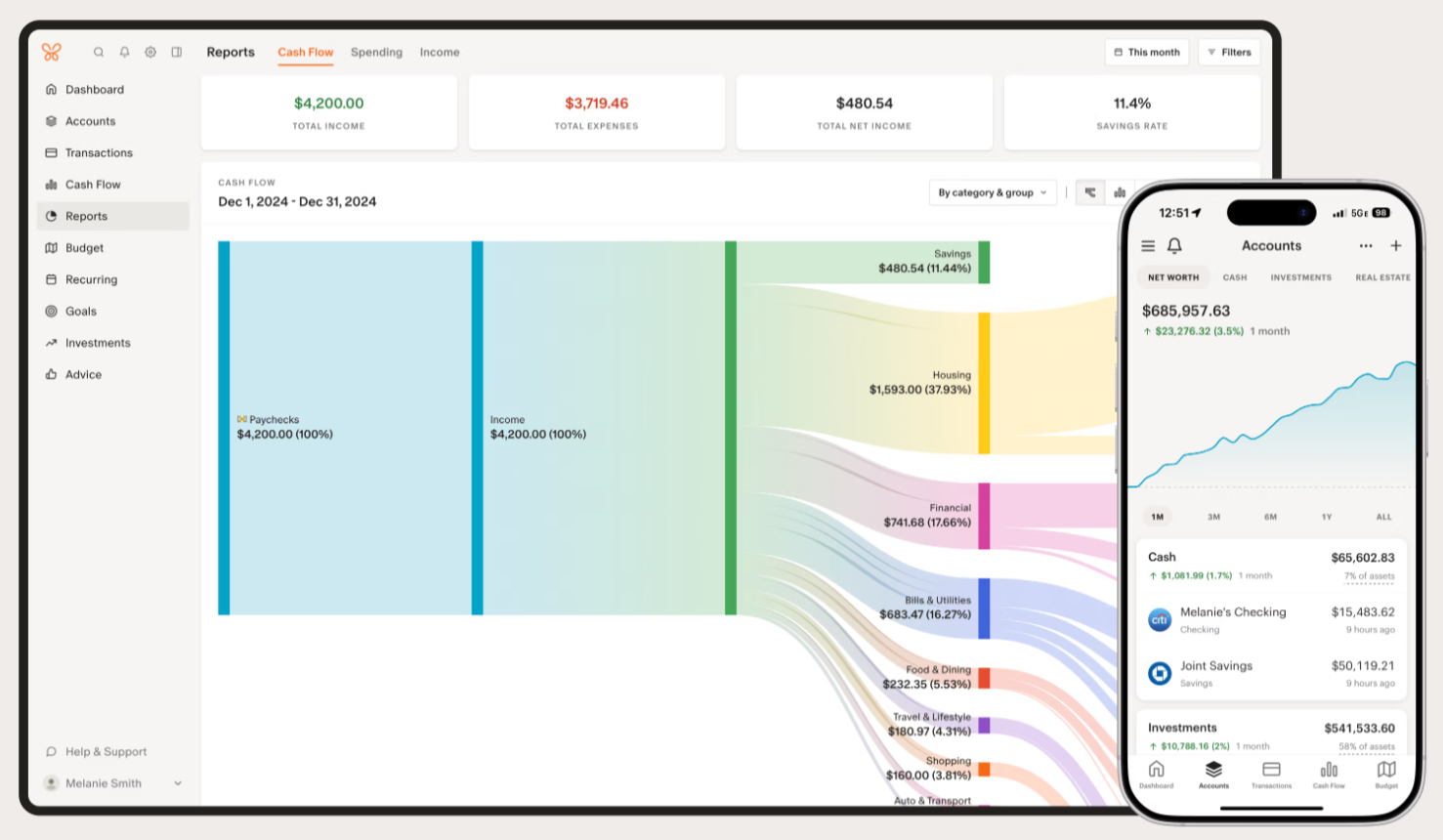

Monarch Money subscription

A 6-month hosted subscription to my favorite all-in-one financial dashboard and budgeting software ($99/year thereafter). A bonus of this bonus: often many months of transaction history is pulled in when you link accounts!

Who is the Finances FIRST Framework best suited for?

This strategy series is geared to individuals (not couples) who are contemplating separation or in the early stages of divorce. The decision to divorce may have been declared, or the words may not have been said yet.

Finances FIRST clients are emotionally done with their relationship and ready to tackle the “business side” of divorce. Their main concerns are financial, practical ones — around the decision to keep or sell the home, splitting other assets and debts, and figuring out child and/or spousal support.

They may be preparing for or managing a temporary separation — going from one household to two — and needing to share parenting time and divide expenses fairly.

With all the changes in their life, they feel overwhelmed with questions, decisions and doubt.

Does this sound like you?

You’re realizing you:

Have been tasked with “project managing” your divorce — whether you initiated it or not! — and your plate is already full.

Don’t have the bandwidth to research everything yourself, and that your divorce settlement is too important to “DIY it.”

Are worried sick that half of the assets will not be enough to support you and your accustomed lifestyle after a divorce (even if in your heart of hearts you know “there is enough” for both of you to thrive).

You’re seeking to:

Divide assets and debts fairly, but not leave money on the table.

Avoid contentious litigation so you can maintain goodwill with your spouse (who may also be your co-parent!).

Minimize legal fees and preserve money for your future (and your kids’ well-being).

You’re looking for:

Hand-holding through the process so you don’t have to guess what is the next best step.

Financial education and coaching to further your long-term stability and security.

A sense of agency—you want to feel in control of the process, not steamrolled by it.

You’re looking to avoid:

Feeling frozen by decisions around money, legal steps, and timing.

Making uninformed or ill-informed financial decisions you’ll regret years later.

Navigating a complex legal and financial maze alone — or with only an aloof lawyer where every email exchange costs $100 or more.

(Have I tapped into the monkey-chatter in your head? 😊)

Why start with the Finances FIRST Framework?

I designed this strategy series to provide wrap-around logistical and emotional support when you need it most. And it’s all-inclusive: once you hire me, there’s no clock running. You’ve got me on your divorce team for up to six months for one flat fee. (Note: If you throw me a request that is outside the scope of this package — like reviewing 100 pages of interrogatories between sessions 😣— I’ll quote you my fee before I dive in.)

Before you commit to an attorney’s hefty retainer, make sure you’re crystal clear on your finances, the complexity of your situation, and the desired outcome for your divorce. Otherwise, you’re not effectively utilizing your lawyer’s time, and you may end up hiring the wrong type of family law attorney for your situation.

I’ve worked in the financial field since 2014 and as a financial coach since 2019, but when I got divorced myself I realized with startling clarity that understanding the marital money is the key to a successful split. I retooled my coaching practice to address this revelation.

Now I guide divorcing clients through my financially focused framework so they can approach their separation and divorce with more clarity, calm, and confidence — and ideally, more resources to fund their next chapter.

The ultimate goal? A financial settlement you won’t later regret.

I’ll be your “thinking partner” in this critical life transition: explaining new concepts, pointing out your blind spots, suggesting creative solutions.

“Coach Shelly’s approach is exactly what I was looking for. I like to think I’m financially savvy, but this [divorce] is a new area for me. For example, I didn’t know anything about Social Security divorced spouse benefits!

Shelly is so organized and efficient, and she manages to make even these hard topics interesting.”

“That was such a supportive & informative meeting this morning! I will be reaching out to make appointments with each of these three lawyers. Thanks so much for the referrals.”

“Shelly, you are MAGIC. I appreciate WHAT you bring to the table and HOW you bring it to the table. I can’t imagine any better support for me in my divorce process.”

Next steps:

If you think the Finances FIRST Framework may the right fit for you and where you’re at, please review my FAQ and make your payment.

If you have an unanswered question or just want to make sure this is your next best step, I invite you to book a complimentary consultation with me.

Take charge of your divorce process with clarity and class — and with your finances always FIRST.